Types of Technology Partnerships

There are as many kinds of Technology Partner program as there are choices of coding language. Taking the time to choose the right option, based on your unique goals and situation, can help maximize your chances of success.

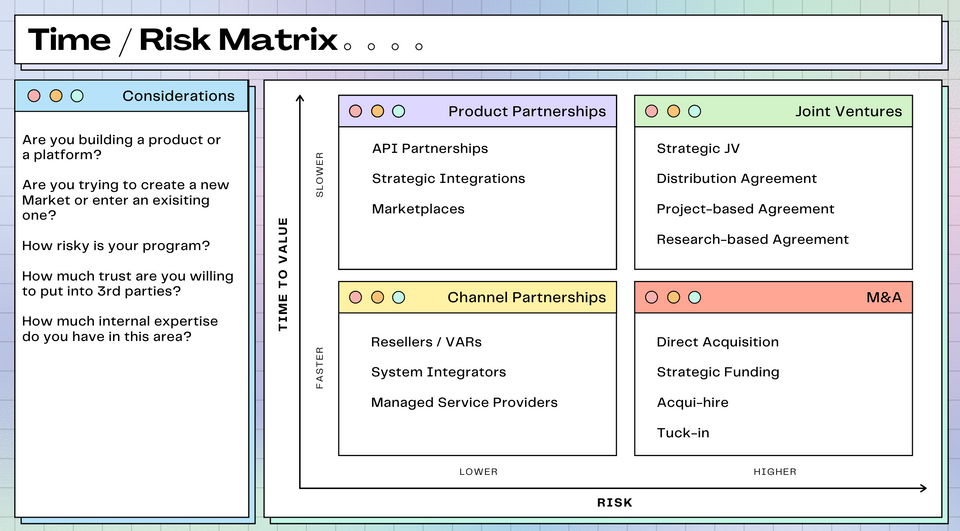

Time / Risk Matrix

Two factors you can consider when deciding what kind of program to build out, are:

- How quickly do you need to show results?

- How much Risk are you willing to assume on your own?

You could also think about these as being proxies for Strategic importance and Competence.

If you are working toward a goal that is highly strategic for the future of the company, maybe your time-frame to show value is longer?

Similarly, if you honestly assess your current competence levels to meet your goals, looking into an acquisition (M&A) or a Joint-Venture (JV) with a partner, makes sense.

Let's have a look at these in more detail.

Channel Partnerships

These types of partnerships most commonly involve working with 3rd parties who will SELL or provide SERVICES around your products.

You could work with experts who can help you sell into new GEOGRAPHIES or new INDUSTRIES or specific customer SEGMENTS (SMB, Mid-Market, Enterprise).

Based on the complexity of your product, you could need partners who can help customers implement your solution, manage the solution or run training programs to help them get the most value from the product.

“Distributors and resellers typically drive 70% or more of a tech vendor’s revenue,” according to the Boston Consulting Group (BCG).

Resellers / Value-added-Resellers (VARs)

These are companies that will focus on selling your product for you (resellers) and can often add additional value in the form of packaging your product with other complimentary products or provide some services to help customers be more successful (VARs). You often sell your products at a discount to these partners and they can resell for a higher price and keep the difference (their margin).

System Integrators (SIs)

These are companies that specialize in helping companies solve hard technical challenges or work through digital transformations. They can be small, local experts or be large, global consulting companies (GSIs) like Accenture. They may help resell your product based on the margin they can make and/or the demand they see from clients.

Managed Service Providers

These companies can sell, but also manage your product on behalf of customers. This can be of value where the product itself can very complicated (SAP) or the product is used in a complex, dynamic industry (digital advertising).

Examples of Channel Partnership Programs

Microsoft have one of the oldest and best known Channel program in the industry, with 95% of their revenue coming via their partners!

Stewart Townsend, who built channel programs at Zendesk and DataSift, recommends companies invest in channel sales when they hit 50+ employees and $1+ million in revenue.

Setting the right expectations is key. “You are not usually going to knock out double-digit millions in revenue from a partnership strategy in year one. You have to get tightly aligned with your executive team and the board as to what they should expect in the short term,” says Sendoso’s Brian Jambor.

Mergers and Acquisitions (M&A)

These partnership scenarios range from buying a company outright, to making a strategic monetary investment in them, to help with alignment and access.

Direct Acquisition

You buy the company and integrate their products, Intellectual Property (IP) and people into your business. This can often be a good choice if you want to enter a new industry or customer segment quickly. The product you acquire will often live-on as a stand-alone offering under your company brand.

Tuck-in

In this scenario, you also buy the company outright, but their products become a FEATURE in your existing portfolio and do not live on as a stand alone offering. This can be a great way to accelerate your roadmap in specific areas.

Acquhire

In this scenario, you acquire another company, but only for the people and their expertise. You often end-of-life (EOL) their product, but you may highly value the domain expertise these people can bring to your organization.

Strategic Funding

Here, you may make an investment in another company. This could be to help increase alignment, and provide more opportunities to partner down the road, or make it easier to work through a full acquisition at a later date. Many large Tech companies have investment fund programs to perform these programs at scale.

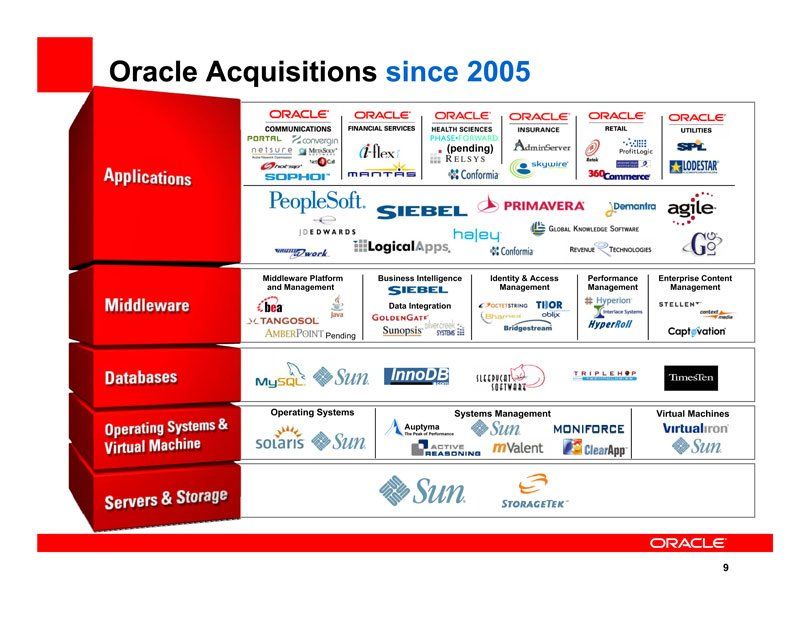

Examples of different types of M&A

Oracle is a good example of a company who makes many different kinds of acquisitions. You can see from the below, that some of those acquisitions have lived on as independent products (Acquisition) and some have become features (HyperRoll) in existing Oracle products.

Joint Ventures (JV)

In this scenario, 2 or more companies, pool resources (money, people, IP) and work toward a shared outcome. They often create a new legal entity to make it easier to share returns and risks.

Strategic JV

This is where companies partner to work toward a larger, strategic goal, which would be harder to achieve independently. Sony Ericsson is an example of a JV between two large companies. In this case, they partnered in the early 2000s with the aim of being a world leader in mobile phones. After several years of operating as a JV, the venture eventually became solely owned by Sony.

Another example of a joint venture is the joint venture between the taxi giant UBER and the vehicle manufacturer Volvo. The joint venture goal was to produce driverless cars. The ratio of ownership is 50%-50% and the business worth was $350 million as per the agreement in the joint venture.

Distribution Agreement

These JVs often focus on trying to enter a new market or geography.

Starbucks frequently utilizes joint ventures to enter new, emerging markets; in 2012, it established a joint venture agreement with Tata Global Beverages to own and manage Starbucks stores in India. This joint venture operates over 216 locations.

Project-based JV

Here companies pool resources with a very specific goal in mind, often for shorter periods of time.

An example here is GSK and Sanofi, two of the world's biggest pharmaceutical giants, joining forces in 2020 to create a vaccine to stop the spread of Covid-19.

Research-based JV

These partnerships often focus on developing complex, new technology which can give partners a strategic advantage, or have become table-stakes to stay relevant in a given industry.

A good example here is BMW and Toyota co-operating on research into hydrogen fuel cells and ultra-lightweight materials, so they can both remain market leaders in these emerging areas.

Product Partnerships

Product, or Platform, Partnerships usually resolve around building integrations with complimentary products from Partners.

They may help fill gaps in your own product portfolio, they may be in response to customer demand or the integrated products may provide a better experience for customers which helps with customer satisfaction (CSAT, NPS) or reduce customer churn.

They may take a little longer to start, than other types of partnerships, but once you build solid foundations here, they can be very scalable and add lots of value for your company and your customers.

Strategic Integrations

This is where companies work together to deeply integrate their products, in a seamless (native, out-of-the-box) way, that tries to make them feel and act like they are the same product.

The logic here is that the combined products provide more customer value, then the siloed products could, and often make the combined solution more competitive and attractive.

Some examples of this kind of partnership:

- In Atlassians code management product, Bitbucket, you can now use security capabilities from Snyk, a leading app security company.

https://bitbucket.org/blog/security-code-scanning - Salesforce and AWS have partnered to allow their customers to more easily access their data cross-platform, to enable easier app development.

https://techcrunch.com/2021/06/23/salesforce-aws-announce-extended-partnership-with-further-two-way-integration/ - Shopify and Stripe have partnered to allow for easy payment processing for Shopify merchants.

https://news.shopify.com/shopify-launches-shopify-payments#

API Partnerships and Marketplaces

In this scenario, a company invests resources in building out a platform, to allow other companies to either integrate their products, or build on-top of the platform.

The technical method often used for this scenario is via an Application Programming Interface (API), which is a collection of code and services that enable this kind of integration.

APIs are everywhere now. Some examples:

- You can get weather data from the National Weather Service API

- You can get movie data from the Open Movie Database API

- You can get traffic data in real-time from the TomTom Traffic API

At some-point, to help customers more easily find these integrations, a company may build a marketplace to showcase these integrations.

You can see some examples of marketplaces that are enabled by APIs at:

Battery Ventures have some interesting data on the evolution of these Marketplaces overtime:

Hopefully you enjoyed that whistle-stop tour of options to partner.

If you enjoyed this piece, please share it. 🙏